When it comes to dealing with windshield replacement insurance, knowing the ins and outs can make a world of difference. From understanding your policy to selecting the right service provider, this guide covers it all.

Let's delve into the essential steps and considerations for filing a claim for windshield replacement insurance.

Introduction to Windshield Replacement Insurance

Windshield replacement insurance is a type of coverage that helps pay for the cost of replacing or repairing a damaged windshield on a vehicle. This insurance can be purchased as a standalone policy or included as part of a comprehensive auto insurance plan.

Having windshield replacement insurance is important because windshields are susceptible to damage from various factors such as rocks, debris, extreme weather conditions, and accidents. Without insurance coverage, replacing or repairing a windshield can be costly and inconvenient for vehicle owners.

Scenarios where Windshield Replacement Insurance is Needed

- Rock chips or cracks caused by debris on the road.

- Damage from extreme weather conditions such as hail or storms.

- Accidents that result in a shattered or cracked windshield.

- Vandalism or intentional damage to the windshield.

Understanding Your Insurance Policy

When it comes to windshield replacement insurance, it's crucial to understand the specific coverage details Artikeld in your policy. This includes information on deductibles, coverage limits, and any exclusions that may apply. Here's how you can navigate through the process of verifying your insurance coverage for windshield replacement.

Identify Coverage Details

- Review your insurance policy documents to find the section related to auto glass coverage.

- Check if your policy covers windshield replacement due to damage from accidents, vandalism, or other covered incidents.

- Take note of any specific requirements or conditions that must be met to qualify for coverage.

Understanding Deductibles and Coverage Limits

- Find out the deductible amount you are responsible for paying out of pocket before your insurance kicks in for windshield replacement.

- Know the coverage limits set by your policy, which may cap the amount the insurance company will pay for replacement costs.

- Consider whether your policy offers full glass coverage with no deductible for windshield replacement.

Exclusions to Watch Out For

- Be aware of any exclusions listed in your policy, such as pre-existing damage or certain types of glass not covered for replacement.

- Understand if there are any restrictions on where you can get your windshield replaced, such as using only approved repair shops.

- Check for any clauses that might void your coverage, like failing to report the damage promptly to your insurance company.

Verifying Insurance Coverage

- Contact your insurance provider to confirm your coverage for windshield replacement and understand the claims process.

- Submit any necessary documentation, such as photos of the damaged windshield, to support your claim.

- Follow the steps Artikeld by your insurance company to file a claim and schedule the replacement with an approved glass repair facility.

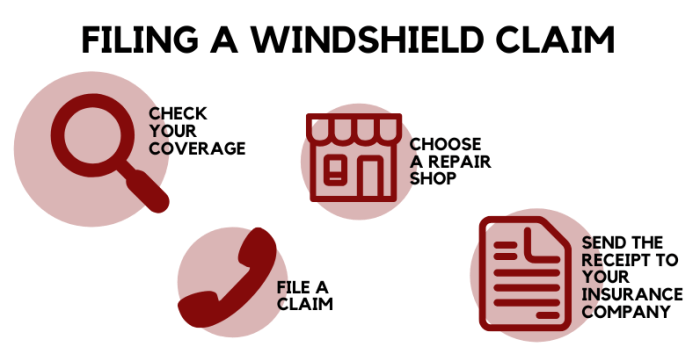

Filing a Claim for Windshield Replacement

When it comes to filing a claim for windshield replacement with your insurance company, it's important to follow a structured process to ensure a smooth and hassle-free experience. Here are the steps you need to take and the documentation required to expedite the claim process.

Step-by-Step Guide to Filing a Claim

- Contact your insurance company: The first step is to notify your insurance provider about the windshield damage and initiate the claim process. Make sure to have your policy details on hand.

- Schedule an inspection: The insurance company may require an inspection of the damage before approving the claim. Arrange for a convenient time for an adjuster to assess the windshield.

- Provide necessary documentation: To support your claim, you will typically need to provide your insurance information, photos of the damaged windshield, and any relevant receipts or invoices from the repair shop.

- Get repair estimates: Obtain estimates from reputable auto glass repair shops for the windshield replacement cost. Your insurance company may have preferred providers for you to choose from.

- Approval and repair: Once your claim is approved, schedule the windshield replacement with the chosen repair shop. Your insurance company will cover the approved amount, and you may need to pay any deductible as per your policy.

Documentation Required for a Windshield Replacement Claim

- Policy details: Have your insurance policy number, coverage details, and contact information readily available when filing the claim.

- Photos of the damage: Take clear pictures of the damaged windshield to provide visual evidence to your insurance company.

- Repair shop estimates: Obtain written estimates from auto glass repair shops outlining the cost of replacing the windshield.

- Receipts and invoices: Keep all receipts and invoices related to the windshield replacement for reimbursement purposes.

Tips to Expedite the Claim Process

- Act promptly: Notify your insurance company about the windshield damage as soon as possible to avoid any delays in processing your claim.

- Be organized: Have all the necessary documentation and information in one place to streamline the claim process and ensure quick approval.

- Follow up: Stay in touch with your insurance company and the repair shop to track the progress of your claim and ensure timely resolution.

Choosing a Windshield Repair or Replacement Service

When it comes to selecting a service provider for your windshield repair or replacement, there are several factors to consider to ensure you receive quality service and a reliable outcome.

Compare Different Service Providers

- Research and compare multiple windshield repair or replacement companies in your area.

- Check online reviews and ratings to gauge the reputation of each service provider.

- Ask for recommendations from friends, family, or your insurance company for trusted companies.

Factors to Consider When Selecting a Service Provider

- Verify that the company is licensed and insured to perform windshield repairs or replacements.

- Inquire about the type of materials and techniques used for the repair or replacement.

- Ask about the warranty offered on the service provided.

- Consider the experience and expertise of the technicians performing the repair or replacement.

Tips on Finding a Reputable and Reliable Windshield Repair Company

- Choose a company that has been in business for several years and has a proven track record of quality service.

- Avoid companies that offer significantly lower prices than their competitors, as this could indicate subpar materials or workmanship.

- Get quotes from multiple service providers to compare prices and services offered.

- Ask for references from past customers to get feedback on their experience with the company.

Reimbursement Process

In the event that you have filed a claim for windshield replacement with your insurance company, understanding the reimbursement process is crucial. This process involves receiving the funds for the windshield replacement service you have already paid for out of pocket.

Receiving Reimbursement

- Once your claim for windshield replacement has been approved by your insurance company, they will provide you with instructions on how to submit your reimbursement request.

- You will need to gather all relevant documentation, such as receipts and invoices, to support your reimbursement request.

- Submit the reimbursement request along with the required documentation to your insurance company as per their instructions.

Timelines for Reimbursement

- Typically, insurance companies aim to process reimbursement requests promptly. However, the exact timeline for receiving reimbursement can vary depending on the company and their internal procedures.

- It is advisable to inquire with your insurance company about the expected timeline for reimbursement after you have submitted your request.

- Be proactive in following up with your insurance company if there are any delays in receiving your reimbursement.

Best Practices for Smooth Reimbursement

- Ensure that you have all the necessary documentation in order and submit it promptly to expedite the reimbursement process.

- Keep a record of all communication with your insurance company regarding the reimbursement request for future reference.

- Stay informed about the progress of your reimbursement request and reach out to your insurance company if you have any concerns or questions.

Ending Remarks

Navigating the process of filing a claim for windshield replacement insurance doesn't have to be daunting. By following these guidelines and being informed, you can ensure a smooth and hassle-free experience when the need arises.

Essential FAQs

Is windshield replacement insurance necessary?

Yes, having windshield replacement insurance can save you from significant out-of-pocket expenses in case of damage.

What documents are typically needed when filing a claim?

You may need your insurance policy, proof of the incident, and any receipts or estimates related to the replacement.

How long does the reimbursement process usually take?

The timeline for receiving reimbursement can vary but is typically within a few weeks after the claim is processed.