Starting with the comparison of Costco Car Insurance with GEICO and Progressive, this article aims to provide a detailed analysis of the pricing and benefits offered by each provider.

Introduction to Costco Car Insurance

Costco Car Insurance offers a range of coverage options, benefits, and competitive pricing for its members. As a Costco member, you can take advantage of exclusive discounts and perks when you purchase car insurance through Costco's partner providers.

Coverage and Benefits

- Costco Car Insurance provides coverage for liability, collision, comprehensive, uninsured/underinsured motorist, and more.

- Members may be eligible for special discounts, such as safe driver discounts or discounts for insuring multiple vehicles.

- Roadside assistance and rental car reimbursement are additional benefits that Costco Car Insurance may offer.

Unique Features

Costco Car Insurance stands out from other providers due to its focus on providing value to Costco members. The insurance plans are tailored to suit the needs of Costco's diverse membership base, offering competitive rates and quality service.

Membership Benefits

- To be eligible for Costco Car Insurance, you must be a Costco member, which requires an annual membership fee.

- Costco members can benefit from the convenience of bundling their car insurance with other Costco services, such as auto buying and travel discounts.

Overview of GEICO Car Insurance

GEICO, which stands for Government Employees Insurance Company, is one of the largest auto insurance companies in the United States. Known for its catchy commercials featuring a gecko, GEICO offers a variety of coverage options, discounts, and competitive pricing for policyholders.

Coverage Options, Discounts, and Pricing Structure

- GEICO provides standard coverage options such as liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection.

- Policyholders can also choose additional coverage options like roadside assistance, rental reimbursement, and mechanical breakdown insurance.

- GEICO offers discounts for safe driving, bundling policies, being a good student, having certain safety features in your car, and more.

- The pricing structure of GEICO car insurance is competitive, with rates varying based on factors such as age, driving history, location, and the type of coverage selected.

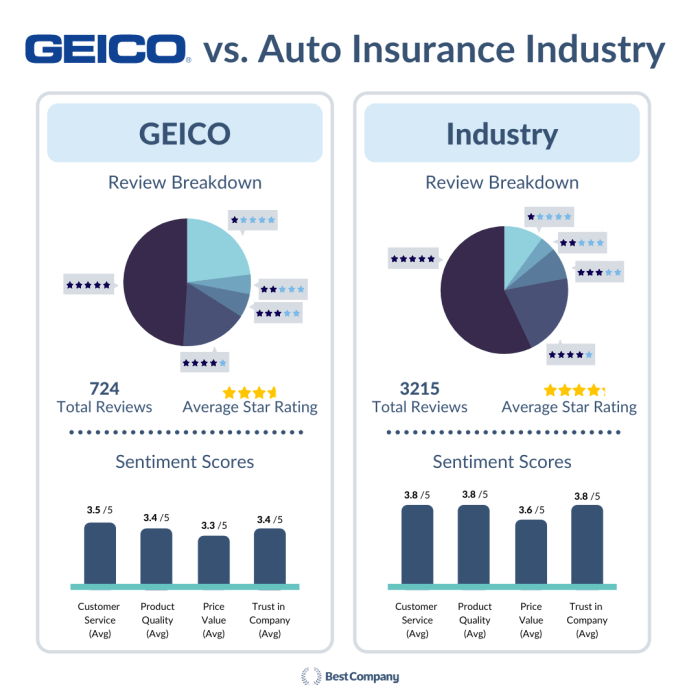

Customer Service Ratings, Claims Process, and Reputation

- GEICO is known for its excellent customer service, with high ratings in customer satisfaction surveys.

- The claims process with GEICO is streamlined and efficient, with policyholders being able to file claims online or through the GEICO mobile app.

- GEICO has a solid reputation in the insurance industry, known for its financial stability and quick claims processing.

Unique Features or Perks

- GEICO offers a mobile app that allows policyholders to manage their policies, pay bills, and file claims conveniently from their smartphones.

- GEICO also has a robust website with resources such as educational articles, coverage calculators, and tools to help customers make informed decisions about their insurance.

- Policyholders can take advantage of GEICO's Emergency Roadside Service, which provides assistance in cases of breakdowns, flat tires, lockouts, and more.

Overview of Progressive Car Insurance

Progressive is a well-known car insurance company that offers a variety of coverage options, discounts, and pricing strategies to meet the needs of different drivers. They are known for their innovative tools and services that aim to make the insurance process easier for customers.

Coverage Options

Progressive provides a range of coverage options, including liability coverage, comprehensive coverage, collision coverage, uninsured/underinsured motorist coverage, and medical payments coverage. Customers can customize their policies to suit their individual needs.

Discounts and Pricing Strategies

Progressive offers various discounts to help customers save money on their car insurance premiums. These discounts may include multi-policy discounts, safe driver discounts, multi-car discounts, and more. They also use pricing strategies that take into account factors like driving history, vehicle type, and location.

Customer Satisfaction and Claims Handling

Progressive has received mixed reviews when it comes to customer satisfaction. While some customers praise their user-friendly website and mobile app, others have reported issues with the claims handling process. It's important for customers to research and read reviews before choosing Progressive as their insurance provider.

Market Standing

Progressive is one of the largest auto insurance companies in the United States, with a strong presence in the market. They have a solid financial standing and are known for their extensive advertising campaigns that have helped them gain recognition among consumers.

Innovative Tools and Services

Progressive is known for its innovative tools and services, such as Snapshot, which tracks driving habits to potentially lower insurance rates. They also offer Name Your Price tool, which allows customers to customize their coverage based on their budget. These tools aim to provide a more personalized and convenient experience for customers.

Comparing Costco, GEICO, and Progressive

When it comes to choosing car insurance, comparing different providers is crucial to finding the best coverage at the right price. Let's take a closer look at Costco, GEICO, and Progressive to see how they stack up against each other.

Key Features, Coverage Options, and Pricing

- Costco: Offers auto insurance through CONNECT, providing competitive rates and various coverage options such as liability, collision, and comprehensive. Pricing is often lower for Costco members.

- GEICO: Known for its affordable rates and various discounts, GEICO offers a wide range of coverage options including roadside assistance and rental car reimbursement.

- Progressive: Offers innovative features like Name Your Price Tool and Snapshot program for personalized rates. Coverage options include liability, comprehensive, and uninsured motorist.

Cost Differences

- Costco: Pricing may be lower for Costco members due to exclusive discounts. However, rates can vary based on individual factors such as driving history and location.

- GEICO: Known for competitive rates, GEICO may offer affordable premiums for drivers with a clean record or bundled policies.

- Progressive: Pricing at Progressive can be influenced by factors like credit score and driving habits, potentially leading to varying costs for different customers.

Customer Satisfaction

- Costco: While customer reviews may be limited due to the newer insurance program, Costco's reputation for quality service and member benefits may translate to high satisfaction levels.

- GEICO: Known for excellent customer service and user-friendly online tools, GEICO often receives positive reviews for its claims handling and policy options.

- Progressive: With a focus on technology and customer experience, Progressive has garnered praise for its mobile app and user-friendly interface, leading to satisfied customers.

Summary

In conclusion, after exploring the key aspects of Costco, GEICO, and Progressive car insurance, it is evident that each has its own unique features and pricing structures. It's essential for consumers to carefully evaluate their options before making a decision.

Quick FAQs

Is Costco Car Insurance only available to Costco members?

No, Costco Car Insurance is available to non-members as well, but Costco members may be eligible for additional discounts.

Does GEICO offer more discounts compared to Costco and Progressive?

GEICO is known for offering a wide range of discounts, which may vary depending on the individual's circumstances. Costco and Progressive also provide various discount options.

Are the coverage options similar between Costco, GEICO, and Progressive?

While there may be similarities in coverage options, each provider may have specific features that differentiate their offerings. It's important to compare the policies to determine the best fit.